home depot tax exempt id military

Create an account and then have your military stats verified. Shop Online and Save on the Products You Need to Complete Your Project.

I Bought My Products At Home Depot And Provided A Receipt Receipt Template Free Receipt Template Credit Card App

Select Save Your tax exempt ID will be automatically applied to online purchases.

. HD you just ask at the register for a military discount show your ID and youre G2G. Enroll in The Home Depot Military Discount. To obtain a Home Depot Tax Exempt ID number you must register to receive one on Home Depots website.

Home Depot honors the military with an additional discount as well as all. Convenient payment options purchase orders and procurement cards accepted. View or make changes to your tax exemption anytime.

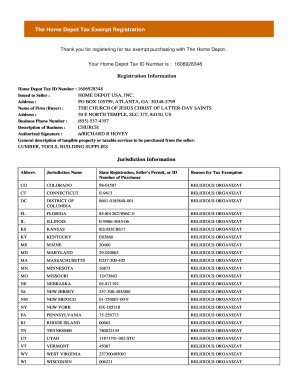

TAX EXEMPT CUSTOMERS 1. Enter your Home Depot Tax Exempt ID number in the Home Depot Provided Tax Exempt ID field. Home Depot Tax Exempt ID.

Go to the Home Depot Tax Exempt Registration Page in your web browser see Resources. If a Pro associate is offering military with tax exempt they need to revisit the SOPs. This might not be the best place to ask this but it shouldnt hurt to try.

Enter your business information and click Continue. You may apply for an EIN in. You have to send them a copy of your license.

Home Depot Tax Exemption Document Author. Volume Pricing Program and special discounts on purchases across the store. Im currently filling out the Home Depot Tax Exempt Application.

EIN for organizations is sometimes also referred to as taxpayer identification number or TIN or simply IRS Number. On the Account Profile page scroll down to Company Details. The Home Depot Tax Exempt ID number is used when making tax exempt purchases in lieu of the state issued tax exempt ID number.

The Home Depot Tax Exempt Registration. Online Tax Exempt Application. Buy Online and Pick Up in Store.

You need to present your military ID it must say service connected below your photo and name in order to get the discount. Establish your tax exempt status. They then refused it and I had to re-register on line and did that.

An Employer Identification Number EIN is also known as a Federal Tax Identification Number and is used to identify a business entity. 1602018739Feb 11 2016 Your Home Depot Tax ID Card 1602018739 Please present this card to the cashier each time you make a tax exempt purchase. All I would like to know is if Home Depot requires Nexus in each state that is being filed for tax exemption since the application demands a separate sales tax ID number.

Tax exempt technically is not a discount and generally offered to gov agencies and ELIGIBLE businesses. The required fields are marked with red asterisk marks. In response to my post last week he emailed me the following statement.

My last comment is about the military service side of things. Sign in with the business account you will be making tax exempt purchases with. Avoid calling out retailers via social media outlets without all the facts.

10-K filing includes an Exhibit 21 subsidiary information. Home Depot Tax Id. Generally businesses need an EIN.

Home Depot Tax Exemption Document Author. That second Home Depot discount excludes all other discounts at this point so unless you had any coupon greater than 10 off they dont exist BTW then stick with the manufacturers and THDs current discounts. Even better its available online and in-store for any way you shop.

Home Depot Tax Id. Theres no cost to participate and no minimum spending requirement to access. I had a customer come to me at the Service Desk to purchase a top-of-the-line Traeger right before Memorial Day and requested tax exempt.

Lowes you ask but then have to verify that you registered thru customer service or online that youre a Vet. Home Depot Tax Id. The employer identification number EIN for Home Depot Inc.

Active duty military members military retirees and eligible Veterans can save on their purchase using the Home Depot military discount. I opened a business account with them and it includes tax exemption. Yes I am a four year veteran Then I got a tax exempt ID from them and used it for years.

I once had a military discount at Home Depot for a few years but they stopped giving me that option. If you qualify as a tax exempt shopper and already have state or federal tax IDs register online for a Home Depot tax exempt ID number. The number is auto assigned by the system during the registration process.

Save with Home Depot Military Discount Benefit. HOW TO GET HOME DEPOT MILITARY DISCOUNTS. The Home Depot Tax Exempt Registration.

The ID number will be numeric only and is displayed on the printed registration document. It worked for less than a month and stopped working. All registrations are subject to review and approval based on state and local laws.

Use your Home Depot tax exempt ID at checkout. All active duty military personnel and retired or disabled veterans and spouses are eligible for a 10 Home Depot military discount at all store locations any day of the week. Customers can redeem this discount in-store by presenting a valid military ID to the cashier at checkout.

To get started well just need your Home Depot tax exempt ID number. Tailored Support for Government Agencies. Ad Get Free Delivery on Over 1 Million Eligible Online Items.

The Home Depot Tax Exempt Registration. We offer a 10 percent discount up to a 500 maximum to all active reserve retired or disabled veterans and their. 1602363709Feb 11 2016 Your Home Depot Tax ID Card 1602363709 Please present this card to the cashier each time you make a tax exempt purchase.

Home Depot has lost me. THE HOME DEPOT INC. Expansive order and delivery options on over 300000 products.

If you click on the link they provide it takes you to the Tax Exempt Purchases page. Home Depot Tax Exemption Document Author. It is one of the corporates which submit 10-K filings with the SEC.

Let us know and well give you a tax exempt ID to use in our stores and online. However that same article also notes that Home Depot offers tax exemption to all active duty military personnel reservists retired or disabled veterans and their immediate familys. Qualifying members receive 10 off eligible purchases up to a 400 maximum annual discount every day all year long.

1611157363Nov 28 2016 Your Home Depot Tax ID Card 1611157363 Please present this card to the cashier each time you make a tax exempt purchase.

Homedepot Tax Exempt Id Fill Online Printable Fillable Blank Pdffiller

Iama President Of A 501c3 Tax Exempt Non Profit That Is Called Fale We Teach People To Pick Locks Ama R Iama

23 Real World Tips For Saving Money At Home Depot

The Tears Are Going To Be Falling Hard R Homedepot

Tax Exempt Purchases For Professionals At The Home Depot

Home Depot Tax Exempt Fill Online Printable Fillable Blank Pdffiller

Home Depot Tax Exempt Fill Online Printable Fillable Blank Pdffiller